The tax treatment in relation to benefits-in-kind BIK received by an employee from his employer for exercising an employment. Stereo set TV video recorder CD DVD player.

Esop Regulatory Rulings 1990 2021 Nceo

It sets out the interpretation of the Director General in respect of the particular tax law and the policy as well as the procedure applicable to it.

. 19 November 2019 42 Perquisites are benefits in cash or in kind which are convertible into money received by an employee from his employer or from third parties in respect of having or exercising an employment. The tax treatment in relation to benefit in kind bik received by an employee. 52019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. In the updated public ruling the irb has provided further. Objective The objective of this Public Ruling PR is to explain - a The tax treatment in relation to benefit in kind BIK received by an employee from his employer for exercising an employment and.

It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy and procedure that are to be applied. A public ruling is an expression of the commissioners opinion about. BENEFITS IN KIND Public Ruling No.

2 Gardener RM3600 per gardener 3 Household servant RM4800 per servant 4 Recreational club membership a Indiviudal membership Membership subscription paid or. Benefits in kindalso commonly referred to as fringe benefits or perksare benefits provided to a director or employee that arent included in their salary or wages. This benefit is treated as income of the employees.

BENEFITS-IN-KIND FOURTH ADDENDUM TO PUBLIC RULING NO. 22 However there are certain benefits-in-kind which are either exempted from tax or are regarded as not taxable. Paragraph 234 of the Third Addendum to Public Ruling No.

Objective The objective of this Public Ruling PR is to explain - a The tax treatment in relation to benefit in kind BIK received by an employee from his employer for exercising an employment and b The method of ascertaining the value of BIK in order to determine the amount to be taken as gross income from employment of an employee. See more of MKT Associates on Facebook. The section mandates that certain BIK exemptions like Maternity expenses traditional medicine are not extended to directors of controlled companies sole proprietors and partnerships.

A Ruling may be withdrawn either wholly or in part by. Prescribed average life span Years Motorcar. 28 Feb 2009 Public Ruling No.

A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia. It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy and procedure that are to be applied. 32013 Date of Issue.

A Public Ruling may be withdrawn either wholly or in part by notice of withdrawal. The objective of this Public Ruling PR is to explain - a The tax treatment in relation to benefit in kind BIK received by an employee from his employer for exercising an employment and. Pages 31 of 31.

There are several tax rules governing how these benefits are valued and reported for tax purposes. These benefits are called benefits in kind BIK. 32013 INLAND REVENUE BOARD OF MALAYSIA Date of Issue.

This Addendum provides clarification in relation to tax exemption on benefit on free petrol received by an employee pursuant to his employment. The method of ascertaining the value of BIK in order to determine the amount to be taken as gross income from employment of an employee. Perquisites are taxable under paragraph.

11 Date of Publication. Benefits that have a monetary value will. Objective The objective of this Public Ruling PR is to explain - a The tax treatment in relation to benefit in kind BIK received by an employee from his employer for exercising an employment and b The method of ascertaining the value of BIK in order to determine the amount to be taken as gross income from employment of an employee.

If you need further details on declaring Benefit in Kind BIK for PCB Computation especially on how to compute the value of BIK kindly refer to the page below. Fund as a disability superannuation benefit to the split tpd life insured. Benefits in Kind Public Ruling No 32013 and Public Ruling 32017.

22004 issued on 17 April 2009 is substituted with paragraph below. Benefits in kind is a tax area which could be complicated and this article is written to give you an overview of the rules involved. 15 March 2013 Page 1 of 28 1.

For further calculation on Benefit In Kind ruling refer here. The Director General may withdraw this Public Ruling either wholly or in part by. These benefits-in-kind are mentioned in.

Kitchen utensils equipment. A Public Ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board. The most common type of Benefit In Kind are.

Objective The objective of this Public Ruling PR is to explain - a The tax treatment in relation to benefit in kind BIK received by an employee from his employer for exercising an employment and b The method of ascertaining the value of BIK in order to determine the amount to be taken as gross income from employment of an employee. VOLA Value of Living Accomodation Public Ruling No 32005 and Public Ruling 32017. 21 Benefits-in-kind received by an employee pursuant to his employment are chargeable to tax as part of gross income from employment under paragraph 131b of the Income Tax Act 1967 ITA.

Thats because we need to file tax exemptions based on LHDNs Public Ruling 112019 for the valuation of BIK under section 83 Non-application. Swimming pool detachable sauna. Benefit In Kind Public Ruling Ghana As The Eu S Migration Partner Dgap Generally you can only deduct charitable contributions if you itemize deductions on schedule a form 1040 itemized deductions.

And one should also be aware of exemptions granted in certain cases. Benefit In Kind is a non-cash allowance. The malaysian inland revenue board mirb issued a new public ruling pr on.

These can be assets or services such as company cars private health insurance or non-business travel and entertainment expenses.

Alan K Nevel Senior Vice President And Chief Equity Officer The Metrohealth System Cleveland Oh Linkedin

Public St Partners Plt Chartered Accountants Malaysia Facebook

With Roe Overturned Economic Disparities Will Worsen Marketplace

Federal Register Patient Protection And Affordable Care Act Hhs Notice Of Benefit And Payment Parameters For 2023

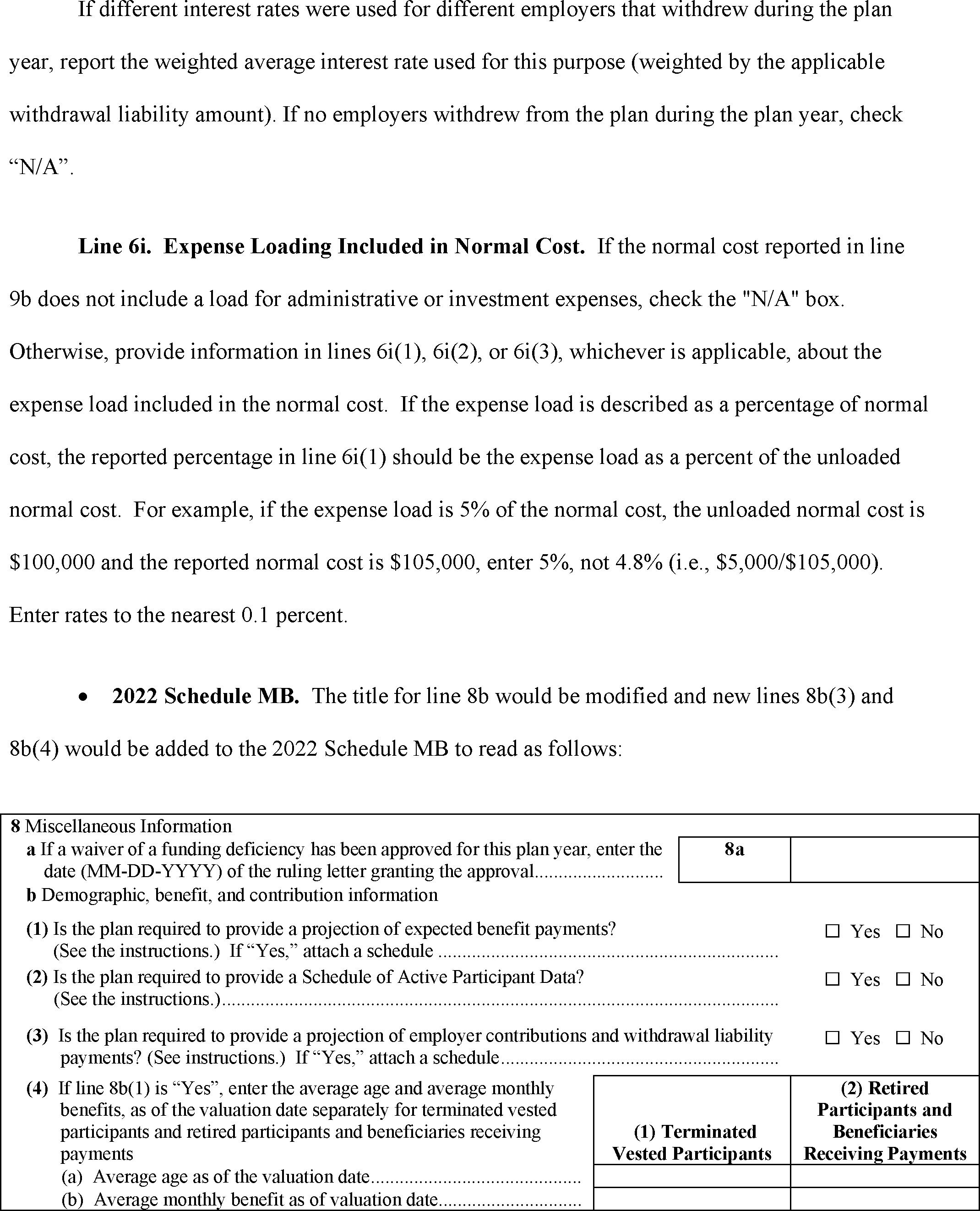

Federal Register Proposed Revision Of Annual Information Return Reports

Nonprofit Law In The Philippines Council On Foundations

In Draft Abortion Ruling Democrats See A Court At Odds With Democracy The Washington Post

The Lancet Global Health Commission On Financing Primary Health Care Putting People At The Centre The Lancet Global Health

Evers Johnson Other Top Politicians Speak Out On Supreme Court Abortion Ruling Wisconsin Public Radio

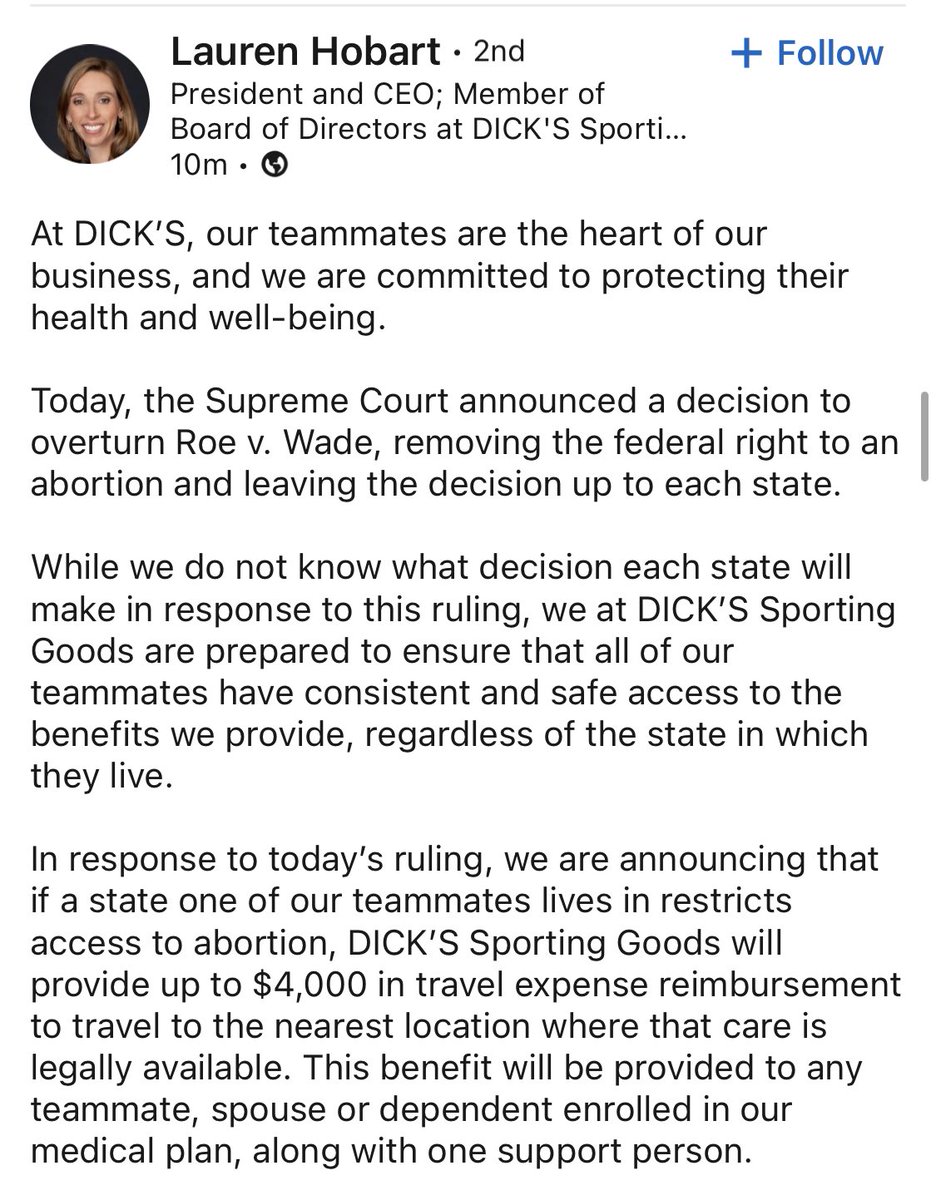

Disney Netflix Comcast Say They Will Cover Employee Travel For Abortions The Washington Post

Rep Erick Allen Erickallen Twitter

Covid News U S Justice Dept May Appeal Ruling That Voided Mask Mandate On Public Transit The New York Times

Covid News U S Justice Dept May Appeal Ruling That Voided Mask Mandate On Public Transit The New York Times